The Resource-Based View and The Concept of Value: The Role of Emergence in Value Creation

DOI:

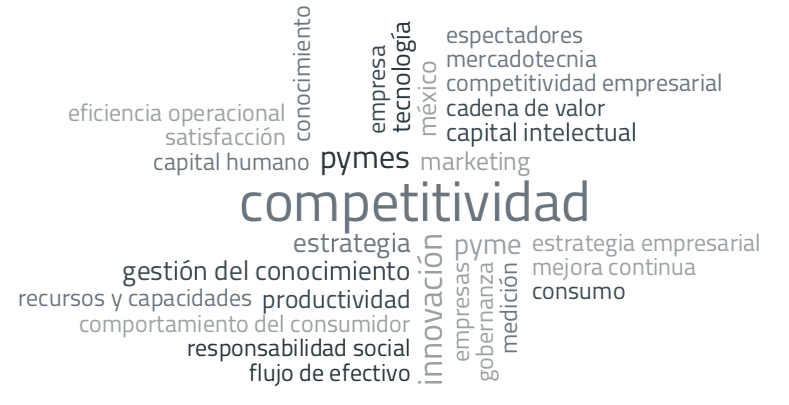

https://doi.org/10.32870/myn.v0i35.6265Palabras clave:

strategy, resource-based view, value creation, emergenceResumen

This theoretical paper deals with the concept of value. It asserts that value is the only and necessary condition in the resource-based view (RBV). It also argues that no resource or strategy is valuable per se: it is related to a configuration of resources, routines, and embedded assets. For example, concerning the RBV attribute of imitation, we can ask to what extent a valuable resource is independent of the rest of resources, and by extension, to what extent a configuration of resources is rare by itself. This paper discusses the emergence of value and it is embeddedness in a configuration of resources. Revising the concept of value could challenge the other main conditions in the RBV: rarity and cost of imitation, impossibility to replace with strategic substitutes. If the relations of these attributes with the rest of the resources are taken into account, we might have a better understanding of how value emerges and how a firm’s resources and capabilities are related with the creation of value.Citas

Alchian, A., Demsetz, H. (1972). Production, Information Costs and Economic Organization, 62 American Economic Review,.777-795.

Alston, L.J. & Gillespie, W. (1989). Resource coordination and transaction costs: a framework for analysing the firm/market boundary, Journal of Economic Behaviour and Organization, 11:191-212.

Bain, J. (1968). Industrial Organization. New York: John Wiley and Sons.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management. 17: 99‑120.

Coase, R. (1937). The Nature of the Firm, 4 Economica, 386-405.

Carrillo, J. C. (1993). Strategic networks: Creating the borderless organization. Oxford: Butterworth-Neinemann Ltd.

Checkland, P. (1999). Systems Thinking, systems practice. Wiley: New York.

Demsetz, H. (1967). Toward a theory of property rights. The American Economic Review, 57: 347-359.

Elkington, J. (1997). Cannibals with forks – Triple bottom line of 21st century business. Stoney Creek, CT: New Society Publishers.

Goel, h: (2010). Triple bottom line reporting: An analytical approach for corporate sustainability. Journal of Finance, Accounting, and Management, 1(1), 27-42.

Granovetter, M. (1985) Economic action and social structure: The problem of embeddedness. American Journal of Sociology. 91: 481-510.

Gulati, R. (2000). Network location and learning: The influence of network resources and firm capabilities on alliance formation. Strategic Management Journal, 20: 397-420.

Hardin, G., 1968, The tragedy of the commons, Science 162, 1243-1248.

Holmberg, John and Karl-Henrik Robèrt. 2000. Backcasting from non-overlapping sustainability principles – a framework for strategic planning. International Journal of Sustainable Development and World Ecology Vol 7, pages: 291-308.

Jensen, M., Meckling, W. (1976). Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure, Journal Financial Economics, 305-360.

Kogut, B. (2000). The network as knowledge: Generative rules and the emergence of structure. Strategic Management Journal, 20: 405-425.

MacMillan, K. and D. Farmer (1979). Redefining the Boundaries of the Firm. Journal of Industrial Economics, 27: 277-285.

McEvily, B. and A. Zaheer (1999). Bridging ties; A source of firm heterogeneity in competitive capabilities. Strategic Management Journal. 20: 1133-1156.

Newbert, S. L. (2007), Empirical research on the resource-based view of the firm: an assessment and suggestions for future research. Strat. Mgmt. J., 28: 121–146. doi: 10.1002/smj.573

Nonaka, I. and T. Nishiguchi (2001). Knowledge emergence: Social, Thechnical, and Evolutionary dimensions of knowledge creation. New York: Oxford University Press

Olson, M. Jr., 1968, The logic of collective action: Public goods and the theory of groups (Schocken Books, New York).

Penrose, E. (1959). The theory of the growth of the firm. Oxford University Press: New York.

Peteraf, M. and A J. B. Barney (2003) Unravelling The Resource-Based Tangle. Managerial and Decision Economics. 24: 309- 323.

Porter, M. E. (1980). Competitive strategy. New York: The Free Press.

Porter, M. E. (1985). Competitive advantage. New York: Free Press.

Porter, M. E. (1991). Towards a dynamic theory of strategy. Strategic Management Journal. 12; 95-117.

Scott, W. R. (1992). Organizations: Rational, natural and Open Systems. Englewood Cliffs, N.J.: Prentice Hall Inc.

Simon, H. (1962). The architecture of complexity. Proceedings of the American Philosophical Society, 26, 467-482.

Takeishi, A. (2001). Bridging inter- and intra-firm boundaries: Management of supplier involvement in automobile product development. Strategic Management Journal, 22: 403-433.

Schmidheiny, Stephan with BCSD (1992). Changing Course (Cambridge, MA: MIT Press), xii.

Shrivastava, P. (1995). The Role of Corporations in achieving Ecological Sustainability. The Academy of Management Review, 20- 936-960

Teece, D. (1993).The dynamics of industrial capitalism: Perspectives on Alfred Chandler’s scale and scope. Journal of Economic Literature. 31: 199-225.

Weick K. E. (1976). Educational Organizations as Loosely Coupled Systems. Administrative Science Quarterly. 21: 1-19.

Descargas

Publicado

Cómo citar

Número

Sección

Licencia

Mercados y Negocios por Departamento Mercadotecnia y Negocios Internacionales. Universidad de Guadalajara se distribuye bajo una Licencia Creative Commons Atribución-NoComercial 4.0 Internacional.

Basada en una obra en http://revistascientificas.udg.mx/index.php/MYN/.

Los autores conservan los derechos de autor.