Financing Decisions: An Approach for the 21st Century

DOI:

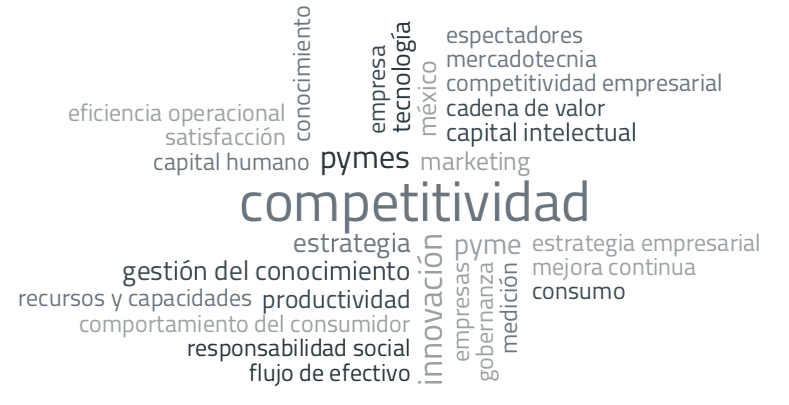

https://doi.org/10.32870/myn.vi53.7774Palabras clave:

Financing DecisionsResumen

Businesses are the essential engine of development in a nation's economy. By improving their profitability and competitiveness, they reduce the risk of failure and boost GDP growth and job creation. This, in turn, encourages investment and promotes a more equitable income distribution, contributing to society's general well-being (Romero, 2013).Citas

Ang, J. S. (1991). Small Business Uniqueness and the Theory of Financial Management, Journal of Small Business Finance, 1, 1–13. https://doi.org/10.57229/2373-1761.1108

Antoniou, A., Guney, Y. & Paudyal, K. (2008). The Determinants of Capital Structure: Capital Market-Oriented versus Bank-Oriented Institutions. Journal of Financial and Quantitative Analysis, 43(1), 59-92. https://doi.org/10.1017/S0022109000002751

Arias, M., Arias, L., Pelayo, M. & Cobián, S. (2009). Factores Institucionales que Influyen en la Decisión de Estructura de Capital de las Empresas en México. Expresión Económica, 22, 49-63. https://doi.org/10.32870/eera.vi22.724

BANXICO. (2024). Sistema de Información Económica. Mexico: Banco de México. Link: https://www.banxico.org.mx/

Berger, A. N. & Udell, G. (1998). The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. Journal of Banking and Finance, 22, 613-673. https://doi.org/10.1016/S0378-4266(98)00038-7

Booth, L., Aivazian, V., Demirguc-Kunt, A. & Maksimovic, V. (2001). Capital Structures in Developing Countries. Journal of Finance, 56(1), 87-130.

Bradley, M., Harrell, G., & Kim, E. (1984). On the Existence of an Optimal Capital Structure: Theory and Evidence. Journal of Finance, 39(3), 97–120.

Cassar, G. (2004). The Financing of Business Start-Up, Journal of Business Venturing, 19(2), 261–283. http://dx.doi.org/10.1016/S0883-9026(03)00029-6

De Angelo, H. & Masulis, R. (1980). Optimal capital structure under corporate and personal taxation. Journal of Financial Economics. 8, 3-29.

Denis, D. J. & Mihov, V. (2003). The choice among bank debt, non-bank private debt, and public debt: evidence from new corporate borrowings. Journal of Financial Economics, 70(1), 3-28. https://doi.org/10.1016/S0304-405X(03)00140-5

Donaldson, G. (1961). Corporate Debt Capacity: A Study of Corporate Debt Policy and the Determination of Corporate Debt Capacity. Division of Research, Harvard University.

Gaytán, J. & Bonales, J. (2009). La Estructura de Capital En Filiales de Empresas Multinacionales de la Electrónica en Jalisco, Bajo Condiciones de Incertidumbre. México: Universidad de Guadalajara. Link: https://hdl.handle.net/20.500.12104/73829

Hernández, C. G. & Ríos B. H. (2012). Determinantes de la estructura financiera en la industria manufacturera: la industria de alimentos. Análisis económico 27(65), 101-121.

INEGI. (2024). Banco de Información Económica. Mexico: Instituto Nacional de Geografía y Estadística. Link: http://www.inegi.org.mx/sistemas/bie/

Kraus A. & Litzenberger, R. H. (1973). A state preference model of optimal financial leverage. Journal of Finance, 28(4), 911-922. https://doi.org/10.2307/2978343

Jensen, M. C. & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4), 305-360. https://doi.org/10.1016/0304-405X(76)90026-X

Lemmon, M. L. & Zender, J. F. (2010). Debt capacity and tests of capital structure theories. Journal of Financial and Quantitative Analysis, 45(5), 1-49. https://doi.org/10.1017/S0022109010000499

Modigliani, F. & Miller, M. (1958). The Cost of Capital, Corporation Finance and The Theory of Investment. American Economic Review, 48, 261-297. http://www.jstor.org/stable/1809766

Modigliani, F. & Miller M. (1963). Corporate Income, Tax and the Cost of Capital: A Correction. The American Economic Review. 53(3). 433-443. http://www.jstor.org/stable/1809167

Myers, S. C. (1984). The capital structure puzzle. The Journal of Finance, 39(3), 574–592.

Myers, S. & Majluf, N. S. (1984). Corporate financing and investment decisions are made when firms have information that investors do not have. Journal of Financial Economics, 13, 187–221. https://doi.org/10.1016/0304-405X(84)90023-0

Romero, F. (2013). Variables financieras determinantes del fracaso empresarial para la pequeña y mediana empresa en Colombia: análisis bajo modelo Logit. Pensamiento & Gestión, 34, 235-277. http://www.scielo.org.co/scielo.php?pid=S1657-62762013000100012&script=sci_abstract&tlng=es

Ross, S. A., Westerfield, R. W. & Jordan, B. D. (2014). Fundamentos de Finanzas Corporativas, McGraw Hill.

Shyam-Sunder, L. & Myers, S. (1994). Testing static tradeoff against pecking order models of capital structure. Journal of Financial Economics, pp. 51, 219–244. https://doi.org/10.1016/S0304-405X(98)00051-8

Tudose, M. B. (2012). Capital Structure and Firm Performance. Economy Transdisciplinarity Cognition, 15(2), 76-82. https://www.ugb.ro/etc/etc2012no2/13_Tudose_final.pdf

Vargas, S. A. (2011). Estimación del Costo del Patrimonio y Costo del Capital por medio de tasas de rendimiento ajustadas al riesgo. Revista de Investigación & Desarrollo, 11(1), 118 – 135. http://dx.doi.org/10.23881/idupbo.011.1-2e

Descargas

Publicado

Cómo citar

Número

Sección

Licencia

Derechos de autor 2024 Juan Gaytán Cortés

Esta obra está bajo una licencia internacional Creative Commons Atribución-NoComercial 4.0.

Mercados y Negocios por Departamento Mercadotecnia y Negocios Internacionales. Universidad de Guadalajara se distribuye bajo una Licencia Creative Commons Atribución-NoComercial 4.0 Internacional.

Basada en una obra en http://revistascientificas.udg.mx/index.php/MYN/.

Los autores conservan los derechos de autor.